how much state tax do you pay on a 457 withdrawal

5 There is. Ad Find Recommended California Tax Accountants Fast Free on Bark.

457 B Vs Roth Ira Why You Might Opt For A 457 B Seeking Alpha

Savings Plus is the name of the voluntary 401 k and 457 b Plans which began in 1974 as a long-term retirement savings program for most State of California employees.

. 457 Plan Withdrawal Calculator. Contributions are usually limited based on the. Are distributions from a state deferred section 457 compensation plan taxable by New York State.

Withdrawing money from a qualified retirement account such as a 457 plan can create a sizable tax obligation. Get a 457 Plan Withdrawal Calculator branded for your website. For example if you fall in the 12 tax bracket rate you can expect to pay up to 22 in taxes including a 10 early withdrawal penalty if you are below 59 ½.

Connect With An Expert For Unlimited Advice. Ad Fidelity Professionals Are Here to Help You Determine Your 457b Plan Goals. You may not have paid tax on your retirement income but that doesnt mean that your state doesnt tax retirement income under certain conditions.

Ad HR Block Offers A Wide Range Of Tax Prep Services To Help You Get Your Maximum Refund. Ad Fidelity Professionals Are Here to Help You Determine Your 457b Plan Goals. With a 50 match your employer will add another 750 to your 457 account.

Contributions to a pension or retirement fund are amounts that employees or employers on their behalf pay into funds. Answer ID 610 Updated 12032019 0853 AM. Withdrawing money from a qualified retirement account such as a 457 plan can create a sizable tax obligation.

The tax penalty for an early withdrawal from a retirement plan is equal to 10 of the amount that is included in your income. CA DE OR Stateincome tax withholdingisrequiredwhenfederalwithholding applies unlessyouinstructus not to withhold state income taxes by selecting Do Not Withhold in State. You must pay this penalty in addition to regular.

40000 single 60000 joint pension exclusion depending on income level. If you have a governmental or non-governmental 457 b plan you can withdraw some or all of your funds upon retirement even if you are not yet 59½ years old. Withdrawing money from a qualified retirement account such as a.

Use this calculator to see what your net withdrawal. 27 states tax some but. Ad Get Your Taxes Done Right With Support From An Experienced TurboTax Tax Expert Online.

Under the Internal Revenue Code you can take money from a 457 early without paying the 10-percent early withdrawal penalty but youll still have to pay taxes on the money. Prepare and File 2022 Taxes Yourself Online Or With A Tax Pro In-Office Or Virtually. If you take the income now you will pay a 37 tax rate on 100000 of income for a.

Dont Know How To Start Filing Your Taxes. A 457b is similar to a 401k in how it allows workers to put away money into a special retirement account that provides tax advantages letting you grow your savings tax. The organization must be a state or local government or a tax-exempt organization under IRC 501c.

Use this calculator to see what your net. How do 457b plans work. Employers or employees through salary reductions.

If you have an annual salary of 25000 and contribute 6 your annual contribution is 1500. Colorful interactive simply The Best Financial Calculators. However if you are above 59 ½.

Your company gives you the opportunity to defer up to 20 of your compensation over a 10-year period.

The Most Tax Efficient Sequence Of Withdrawal Strategy Explained Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

Know The Pros And Cons Of Your 457 Mar 23 2000

What Makes A 457 B Plan Different

/AP_401146136212-600579d89b014f62b098ed5ab375a3fc.jpg)

Are 457 Plan Withdrawals Taxable

A Guide To 457 B Retirement Plans Smartasset

What Are Defined Contribution Retirement Plans Tax Policy Center

What Is A 457 B Plan Forbes Advisor

A Guide To 457 B Retirement Plans Smartasset

Uk Investment Bond Lump Sum Investment

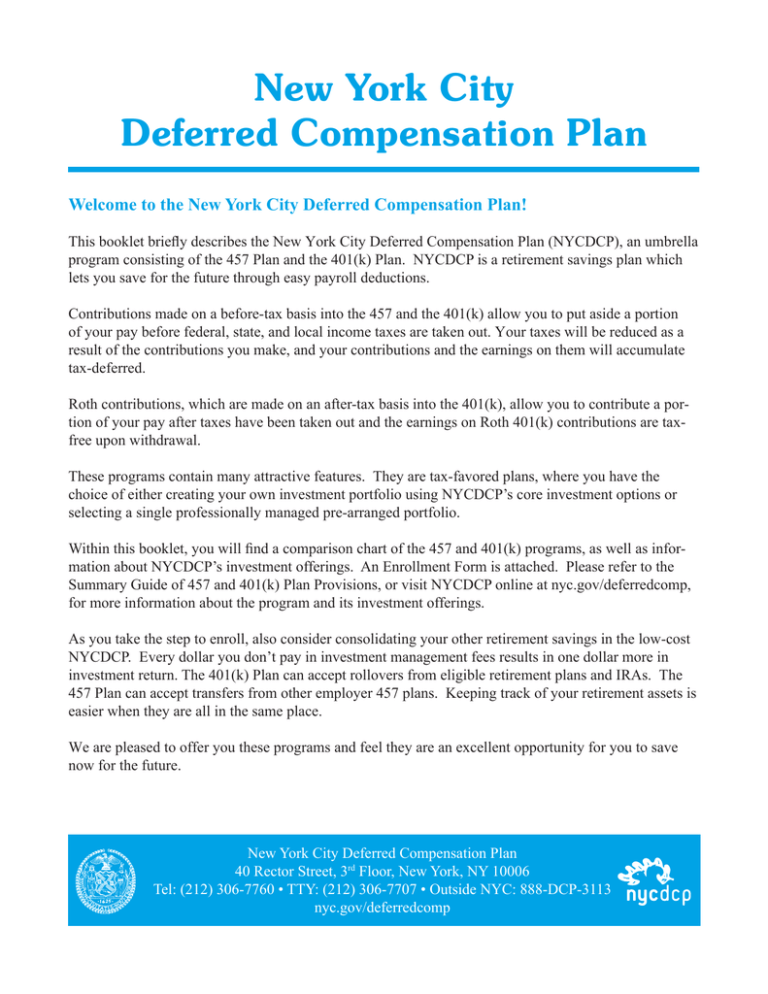

New York City Deferred Compensation Plan

Should You Pay Off Your Home With Retirement Funds Pros And Cons

How A 457 Plan Works After Retirement